count_ratio <- exp(coef(reg)[-1])

conf_int <- exp(confint(reg))[-1, ]

driver_age_vars <- grep("^DrivAge", names(count_ratio), value = TRUE)

data_age <- tibble(

variable = driver_age_vars,

coefficient = count_ratio[driver_age_vars],

lower_bound = conf_int[driver_age_vars, 1],

upper_bound = conf_int[driver_age_vars, 2]

)

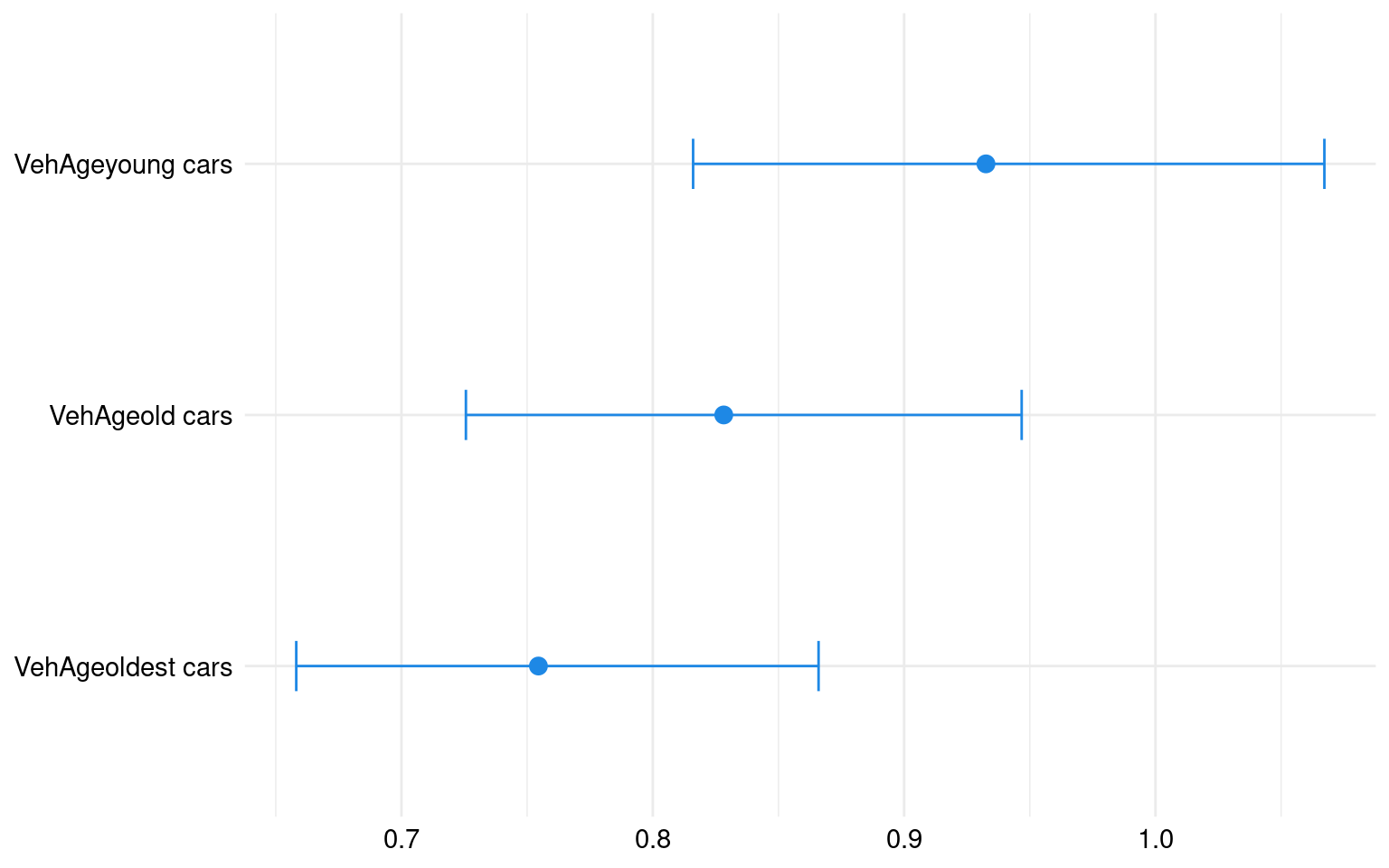

driver_vehage_vars <- grep("^VehAge", names(count_ratio), value = TRUE)

data_vehage <- tibble(

variable = driver_vehage_vars,

coefficient = count_ratio[driver_vehage_vars],

lower_bound = conf_int[driver_vehage_vars, 1],

upper_bound = conf_int[driver_vehage_vars, 2]

)

data_age$variable <- factor(data_age$variable, levels = rev(driver_age_vars))

ggplot(

data_age,

aes(

x = coefficient,

y = variable,

xmin = lower_bound,

xmax = upper_bound

)

) +

geom_point(stat = "identity", size = 3, color = "#1E88E5") +

geom_errorbar(

width = 0.2,

position = position_dodge(width = 0.6),

color = "#1E88E5"

) +

labs(

x = NULL,

y = NULL

) +

global_theme()